Personal Finance Apps

With everything that's gone on in 2020 lots of people are having to be extra careful with what they are and aren't spending their money on. I've always been really careful with what I do with my money, making sure that I'm spreading my risk, and also trying to stay on top of what I do with it so that I can make the most of it! This post is my Top 5 Personal Finance Apps that I'm using at the moment to help me with this!

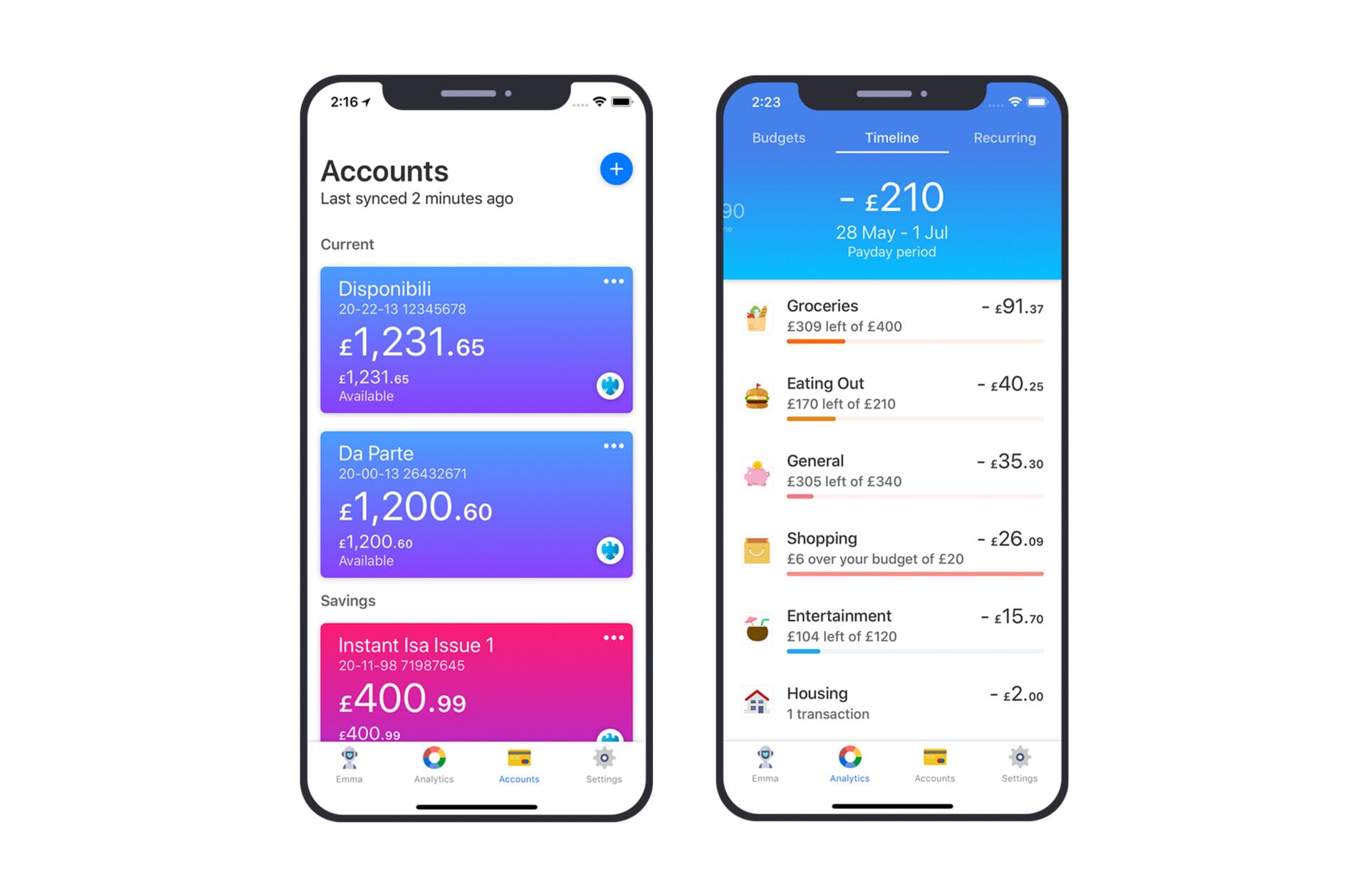

Emma

Emma is your personal banking friend. You can input your bank details, credit cards into the app and it keeps tabs on where everything is and what you are doing with it. It reminds you when you've got money going out, where you spent it and if you might be able to save by moving elsewhere.

You can input budget figures to keep on top of things, see how you track against the anticipated spending and this is all changeable from either being on month to month or pay packed to pay packet spend.

You're able to look back over previous months and compare the costs of what's going in and out and see what's falling into certain categories.

To be fair I'm someone who has money going all over the place at different times of the month. Although I do keep good tabs on it Emma really helps you break it down and explain exactly that you are spending all your money on Amazon when you think that you are only spending a few ££ a month!!

My only wish is that the auto sync (which is quite good with a number of "high Street" banks) could be linked to more services and more bank accounts. However I don't think that this is so much Emma's fault more the linking of other service providers.

This is my number 1 personal finance app at the moment!

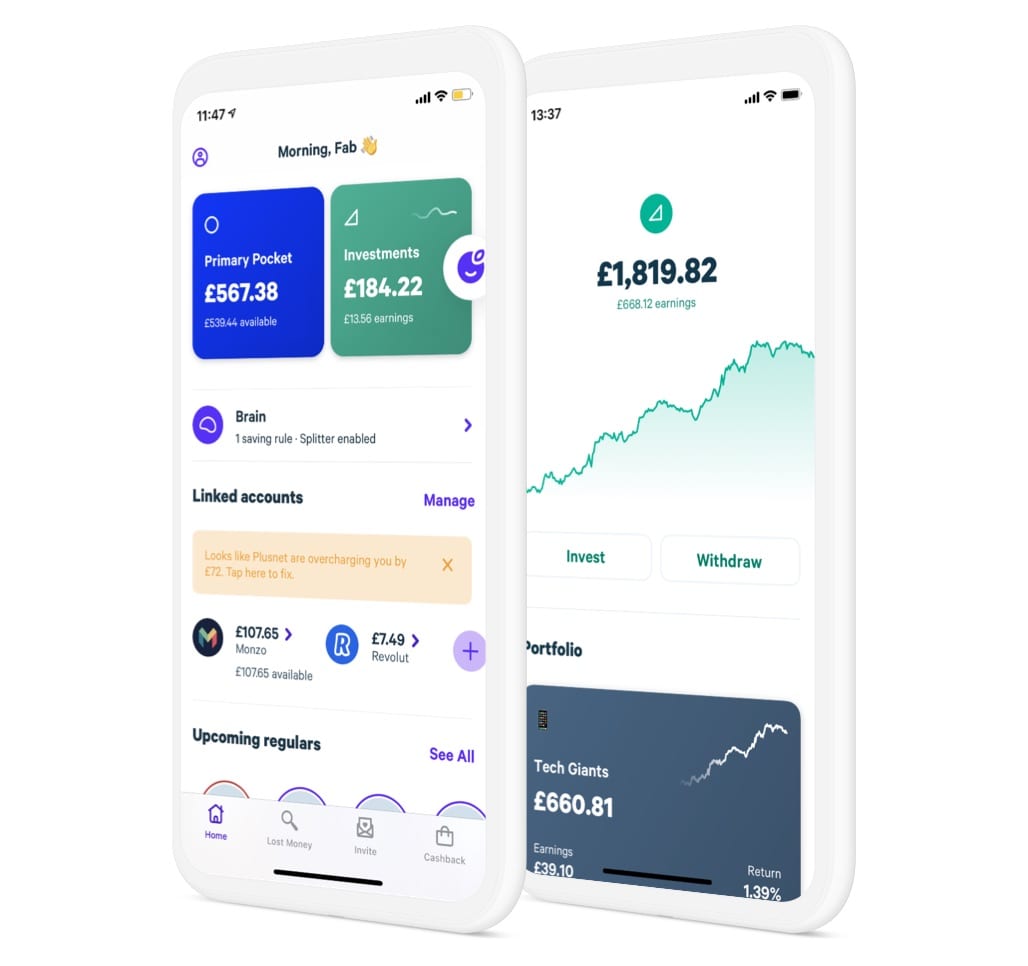

Plum

If you said that there was an app that took money out your bank account on a daily basis - you would think that's just crazy. However this is exactly what the app Plum does. I don't use cash anymore. I know that's probably like a lot of people, but what I used to have was a "money"pot of where I chucked my change like 1-20p's. This is the modern day version.

Plum pulls money from your account on a daily basis and puts it into it's own app. You don't notice the £2-4's that leave the account and you can easily find at the end of a month that it's tucked away £100 for you. Now that might not sound a lot of "saving" but when you are saving without realising because the app does it for you it's just great!

You have plenty of options to where you put your money. Want easy access to it? Great stick it in the every day fund. Want to tuck it away for the longer term? Great it can do that - and even set you up with putting it into a ISA of your choice! Of those ISA's it give's you choices of risky or less risky ones of course that varies the possibility on the returns you are going to get.

I just love this app because it does it all for you and you don't really notice the money moving to your savings account.

Trading 212

Trading 212 has been a bit of a craze of the shut down. For the everyday person the ability to buy and sell shares has always perhaps been a bit of a mystery how to do it without huge charges from banks, or needing to look at computers screens with multiple phones attached to your ears like you see on the Wolf of Wall street... It doesn't need to be like that anymore.

With trading 212 you can invest your money into a number of different platforms. The App allows you access to the the financial markets with free, to use apps, enabling anyone to trade equities, Forex, commodities and more. They offer zero commission stock trading services all from the control of your own hands.

If you are nervous about stocks and shares or trading there is a very helpful practice version that allows you to play with fake money. I've only used the Investing side of the platform. The CFD side of trading isn't something that interests me. (It's also possible to lose a LOT of money when you don't know what you are doing)

Investing

On the invest side you can place you money by buying shares in your "household" named businesses like Amazon, Facebook, Tesla etc.. The nice thing is that although Amazon is listed at more than £3000 you don't need that to buy a share. You can buy that portion of a share with what you have to invest. You can also create "pies" so you can spread your risk investment over a number of different shares.

Any stock is available on the app - but Trading 212 gives you "popular" and other such good tips for starting out!

If you want to get started - use this link that gives you (and me!) a free share. www.trading212.com/invite/Gux3CpnM

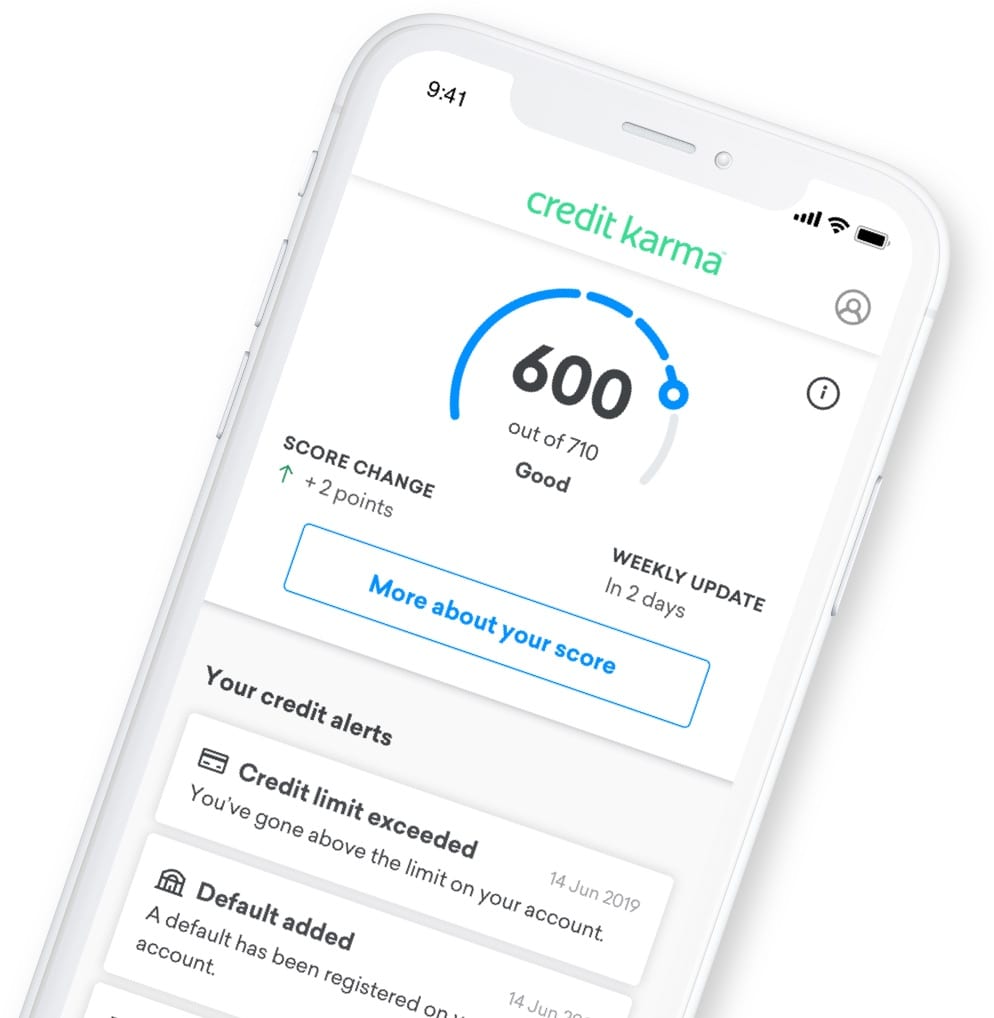

Credit Karma

Whilst there are many Credit referencing companies and many of them have Apps (Experian, Clear Score etc..) I think that Credit Karma offers the most up to date information at any time.

Credit Karma shows your credit score in an easy to read way and explains where you might be able to improve your score. You can see all your accounts in one place, choose a personal credit score goal to achieve, and it recommends personal finance products that you are eligible to purchase. Credit Karma also alerts you to any changes in your credit score, so you can keep an eye on any unusual transactions and monitor issues that may be affecting your score. I also like that unlike other Apps Credit Karma updates every 7 days rather than others that do every 30 days.

Keeping a good credit score is so important to getting your finance in place and opens you so many more doors to borrowing and lending.

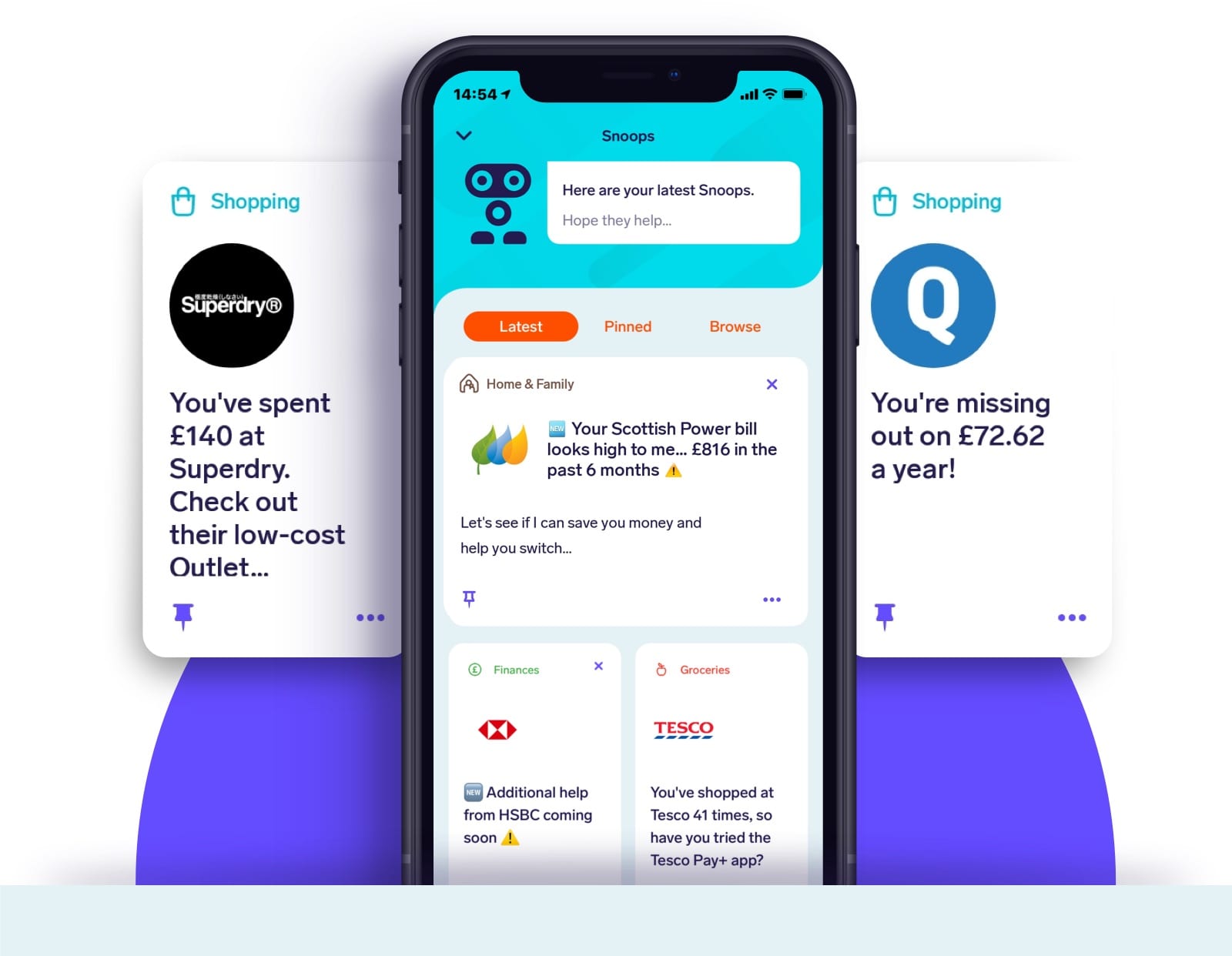

Snoop

Snoop is the latest favourite on the personal finance apps list. Although it works in the same way as Emma linking your accounts together and telling you your overall balances. It goes a step further by suggesting ways where you can save money by "snooping" on what you are spending.

So on the first loading of my accounts it scarily told me how much that I had paid to Sky for the last 18 months, advising me that I was in the top 10% of all Sky account spenders. That worried me!

Snoop also tells you where you are overcharged by companies and show you how to find better deals and make more savings. The personal finance app also tracks where you regularly spend your money so it can find clever ways of helping you save in your favourite places.

I certainly don't mind it Snooping on me!

So those are my top 5 personal finance apps! There are others that I know others like such as Mint, Klarna, Good Budget - all do similar things to the one's I've listed above but it's all down to personal choices.

So what apps do you like to use? What's your favourites? Leave me your favourites below!

Ben